The two brokers involved in a prime broker transaction will utilize TradeSuite ID to match the transaction that is to be settled. For a trade, the executing broker (of street-side trade) will always submit the confirmation and the prime broker will affirm that trade.

For a transfer, the prime broker who is delivering the asset will always submit the confirmation acting in the role of the executing broker. (Note: If a prime broker is receiving an asset with a short position, then they will be acting as the executing broker and generating the confirmation for that asset with the short position)2. The contra prime broker, acting in the role of the agent, will affirm that asset position(s) that is to be transferred for the Hedge Fund.

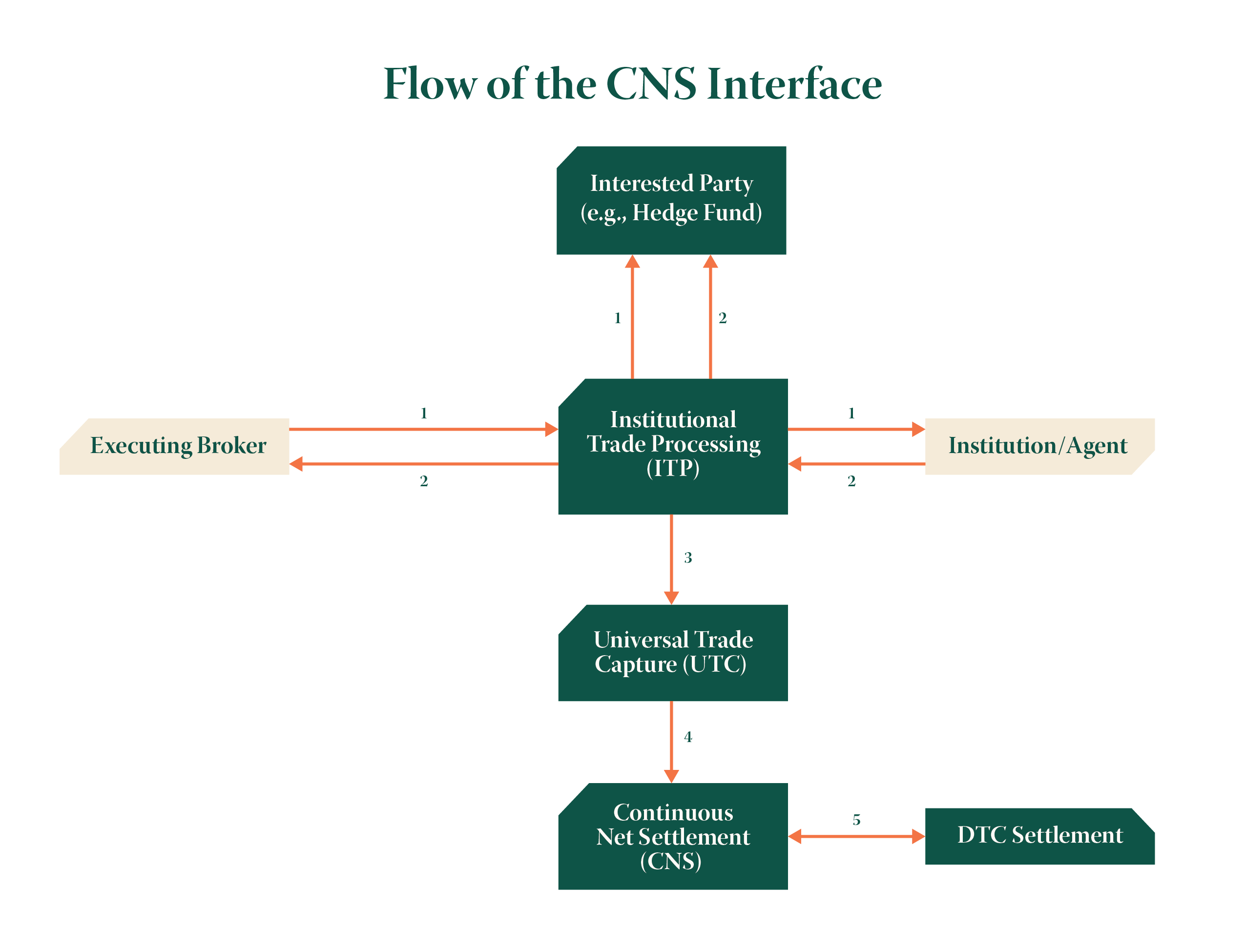

Whether a trade or a transfer, ITP will forward the affirmed transaction to NSCC’s UTC system where it is processed in market code 90 (DTC ID -Prime Broker). Additionally, once received NSCC will apply its trade guaranty to that transaction. For settlement, UTC will forward the transaction to CNS where it will be netted with a prime broker’s other CNS settlement activity for their same clearing participant number.3

- Executing broker submits confirmation in ITP. Confirmation is sent to Institution, Agent (always a Prime Broker) and Interested Party (if applicable)

- Institution/Agent affirms confirmation. Affirmation is sent to Executing Broker and Interested Party (if applicable)

- ITP sends affirmation (of transferred asset) to NSCC's Universal Trade Capture (UTC) System

- UTC sends transaction to CNS for settlement. (Note: This transaction will net with all other street side activity that the Broker has settling in CNS on settlement date)

- CNS interfaces with DTC's book entry settlement system to process DO movements of long and short positions with clearing Members

2 The prime broker who is submitting the confirm must use an Executing Broker ID that is eligible to settle CNS

3 If the security is eligible for CNS at the time of affirmation, then ITP will forward the affirmed transaction to UTC. If the security subsequently becomes ineligible for CNS before UTC sends to CNS, then UTC will include the transaction in its multilaterally netted guaranteed balance order process. In this process, a clearing Member will be assigned a balance order(s) to settle with another NSCC Clearing Member (not necessarily the one who was the original counterparty to the transaction). These balance orders are settled at a uniform settlement price (or mark-to-market) and are guaranteed by NSCC until settlement date.