DCC&S is conveniently accessible via mainframe over DTCC’s SMART (Securely Managed and Reliable Technology) connection or through MyDTCC Web Portal that gives DTCC clients direct access over the Internet to services provided by DTCC's subsidiaries.

There are two types of DCC&S processing scenarios :

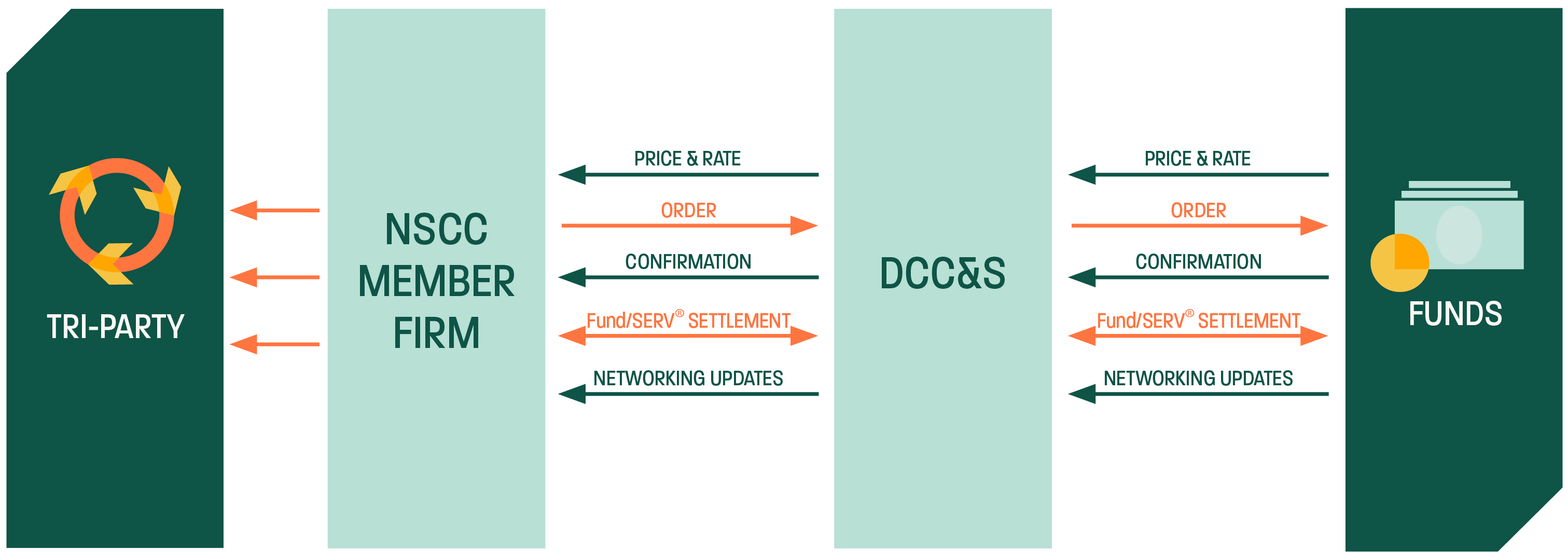

1. Dual–Party Processing:

Firms processing transactions as a record keeper/third party administrator (TPA) and trustee can submit Fund/SERV transactions (buys, sells and/or exchanges) and also perform money settlement with NSCC.

Clearing firms may also transact in a similar capacity and can process transactions from outside record keepers, TPAs, trustees and other constituents.

In this scenario, both firm and fund are NSCC members.

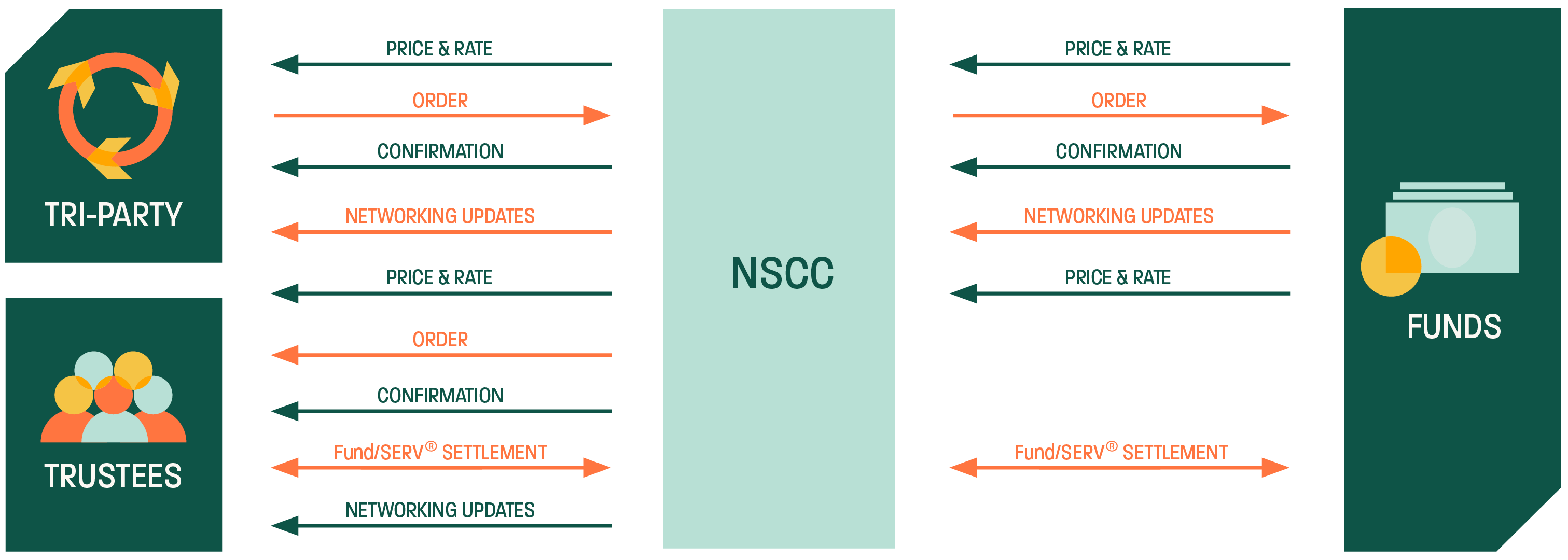

2. Tri-Party Processing:

An NSCC TPA member who processes as a record keeper for retirement plans can submit Fund/SERV transactions (buys, sells and/or exchanges) and obligate (based on existing agreement between the TPA and the settling entity) an NSCC broker/dealer, bank, trust company or insurance company for settlement.

In this scenario, TPA/record keeper, settling entity and fund are NSCC members.

High Level Process Flow (for both trading scenarios):

- NSCC settling entity (e.g., broker/dealer, bank/trust, insurance company, etc.,) can establish individual account information via MF’s Networking service. Typically, this occurs prior to the first trade.

- NSCC members can receive the daily Price and Rate File in order to price buys, sells and exchanges, enabling them to prepare transactions and move money and/or take action.

- After compiling and pricing transaction information, the NSCC member submits transactions to NSCC for processing, using either dual or tri-party processing methods.

- Upon completion of editing, Fund/SERV transmits orders to fund clients and the NSCC settling member (if tri-party scenario). Funds confirm or reject the orders through Fund/SERV.

- All confirmed transactions settle at NSCC. On the morning of T+1, NSCC provides settling members and funds with a net settlement figure and a summary of purchases, redemptions and exchanges. NSCC TPA members can also receive a copy of settlement files “for information purposes only” in order to reconcile confirmed transactions.

- Account activity, position updates and dividend information can be shared between NSCC firms and funds via the Networking service.