Throughout the settlement processing day, as transactions are processed against a participant’s account, settlement debits and credits are updated in the settlement system on a real-time basis.

DTC debits and credits arise primarily from securities transfers versus payment, but are also incurred from payment orders and distributions including principal and income payments for securities credited to the participant’s securities account. NSCC debits and credits are also tracked throughout the day and result primarily from NSCC’s Continuous Net Settlement (CNS) activity. At the end of the day, a final net debit or net credit is calculated for DTC – and, if applicable, NSCC – for each participant account.

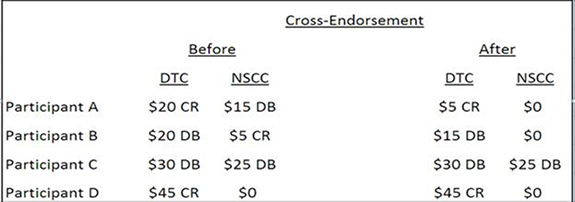

Through cross endorsement between DTC and NSCC, a participant’s DTC and NSCC settlement balances are netted at the legal entity level.

The example below illustrates how cross endorsement introduces settlement efficiencies into the end-of-day settlement process:

Upon the completion of cross endorsement, a final net debit or credit balance is determined for each participant. Debits reflect a participant’s obligation to pay DTC while credits reflect an obligation to pay the participant.

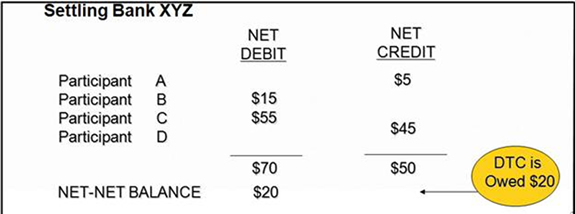

Each participant must choose a settling bank that is also a DTC participant with access to the Fedwire system and NSS to act on its behalf when settling with DTC. DTC further reduces money transfers by netting participant balances at the settling bank level, which allows a settling bank to settle for multiple participants via a single Fedwire instruction rather than settling each individual participant balance.

The example below illustrates how netting at the settling bank level introduces additional settlement efficiencies into end-of-day settlement:

Settling banks, acting on behalf of participants, acknowledge or refuse to settle participant balances. Upon acknowledgement from all settling banks, DTC collects and disburses settling bank balances through the Federal Reserve’s NSS, which directly posts debits and credits to settling bank accounts.