Even in the unprecedented volatility we’ve experienced after the coronavirus pandemic began shaking the markets, DTCC’s Trade Information Warehouse (TIW) has been seamlessly managing major credit events, including in some cases the payment calculation and settlement of tens of thousands of positions for bankruptcies.

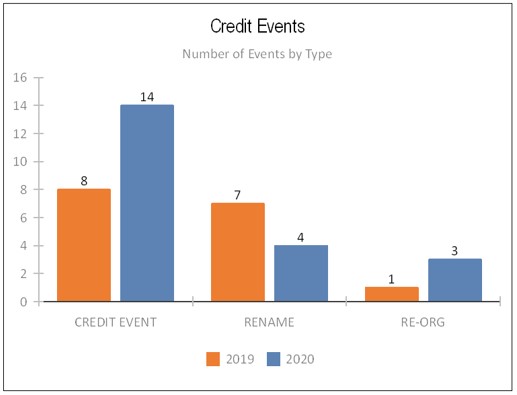

It’s just over halfway through 2020 and the markets have already seen more “events” than all of 2019. That includes bankruptcies and corporate actions, such as name changes and reorganizations. All told, there have been 21 events this year (through the week ending July 31), compared to last year’s total of 16.

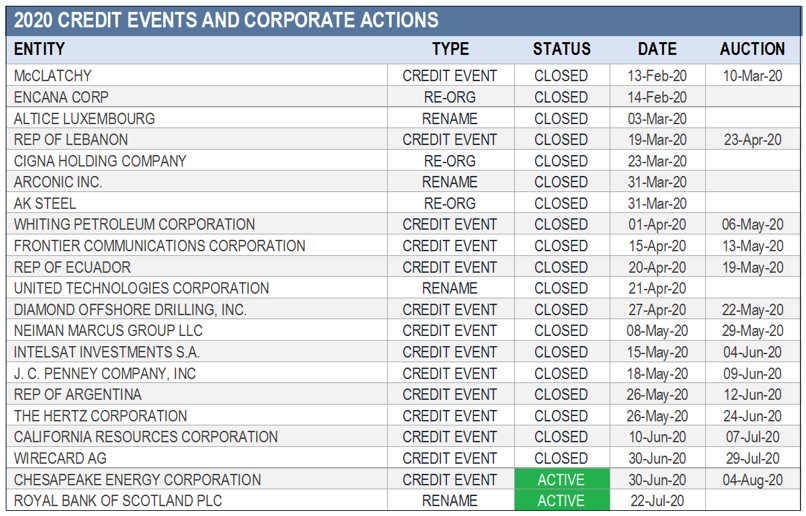

A look at the events recorded under TIW in 2020 compared to 2019 (as of the week ending July 31, 2020).

Some of the recent, major credit events so far this year include J.C. Penney, Neiman Marcus and Hertz Corporation filing for bankruptcy, and Argentina failing to make coupon payments on USD-denominated bonds.

Spotlight on Corporate Bankruptcies

The auction for Whiting Petroleum, the hydrocarbon exploration firm headquartered in Denver, Colorado, was successfully processed by TIW on May 7 with settlement taking place 3 days later. Nearly 35,000 open positions were processed for a gross settlement of $6.7 billion.

TIW’s processing of the auction for luxury retail chain Nieman Marcus was held on May 29 with just under 29,000 trades processed. Settlement took place on June 3 with $6.6 billion in gross settlement obligations.

Another household name retailer, J.C. Penney, Inc., filed for bankruptcy in the U.S., triggering a June 9 auction. TIW processed over 30,000 trades and netted down nearly $9 billion in gross settlement obligations to a cash net of just $2.1 billion.

Settlement of the Hertz Corporation’s bankruptcy event took place on June 29 in which $5.6 billion in gross obligations were netted down to $1.1 billion.

When a credit event happens – such as the string of major corporations that have filed for bankruptcy so far this year – TIW supports the trade processing associated with these events, which may trigger pay-outs for the buyer of credit protection (for the underlying reference entity of the credit derivatives).

So far in 2020, the dollar value of gross cash flows for credit events has reached $75 billion (as of the week ending July 31), compared to last year’s gross total of $21.9 billion.

There have been 21 credit events and corporate actions this year (as of the week ending July 31, 2020).

"Despite the uncertainty and volatility in the markets, TIW continues to seamlessly provide lifecycle event processing,” said Marcus Denne, Executive Director, TIW Product Management. “It’s a testament to the hard work and dedication of the entire TIW team.”

Spotlight on Sovereign Defaults

The first sovereign nation to default on its debts in 2020 was the Republic of Lebanon, resulting in an April 23 auction processed by TIW, in which $4.3 billion in gross settlement obligations were netted down to $1.4 billion.

The following month, TIW successfully managed the Republic of Ecuador’s default auction, netting down an almost $104.7 million obligation to $94.4 million.

The largest and most recent sovereign to default by the Republic of Argentina, for which TIW was able to seamlessly net down a $18.8 billion gross settlement obligation to $5.9 billion, resulted in a nearly 3:1 netting efficiency.

Record-Keeper for the World’s Credit Derivatives Market

Since its creation nearly 15 years ago, TIW has streamlined a process that used to be handled on paper.

Buyers and sellers of credit protection once confirmed their trades on documents that could be up to 40 pages in length. It would take weeks for the contracts to be reviewed line-by-line.

In 2003, a global matching service to automate the process for credit default swaps (CDS) was established. Three years later, TIW launched, creating a “gold record” used for the calculation of swap payments.

It was the industry’s first infrastructure for the record retention and asset servicing of credit default swaps worldwide. Since then, it has processed hundreds of unique credit events. In October 2008, TIW processed its largest credit event to date, in terms of number of positions, with the Washington Mutual bankruptcy. And 2009 marked TIW’s biggest year for credit events, with 50 events processed in that 12-month period.

Other notable credit events include Greece’s sovereign default in 2012 and the Sears Roebuck bankruptcy, processed through TIW in January 2019.

Today, virtually all over-the-counter credit derivatives in the institutional marketplace are registered in the warehouse. TIW also serves as a critical source of information for the industry, helping to dramatically increase transparency on the size and depth of the credit derivatives market.

Learn more about DTCC’s TIW.