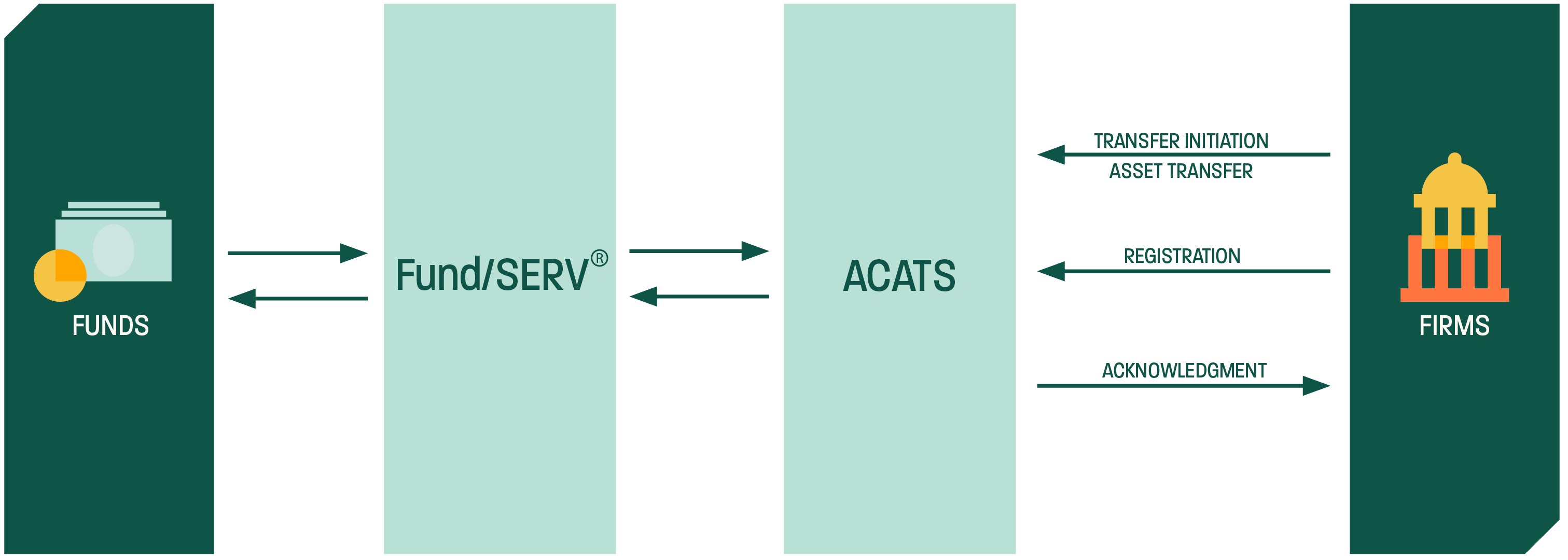

Customers generally initiate account transfers by submitting completed Transfer Initiation Forms (TIFs) to the new receiving firm. The new receiving firm enters the relevant transfer information into ACATS. Once the transfer information is entered into ACATS, NSCC assigns control numbers and sends control reports to both the delivering and receiving firms.

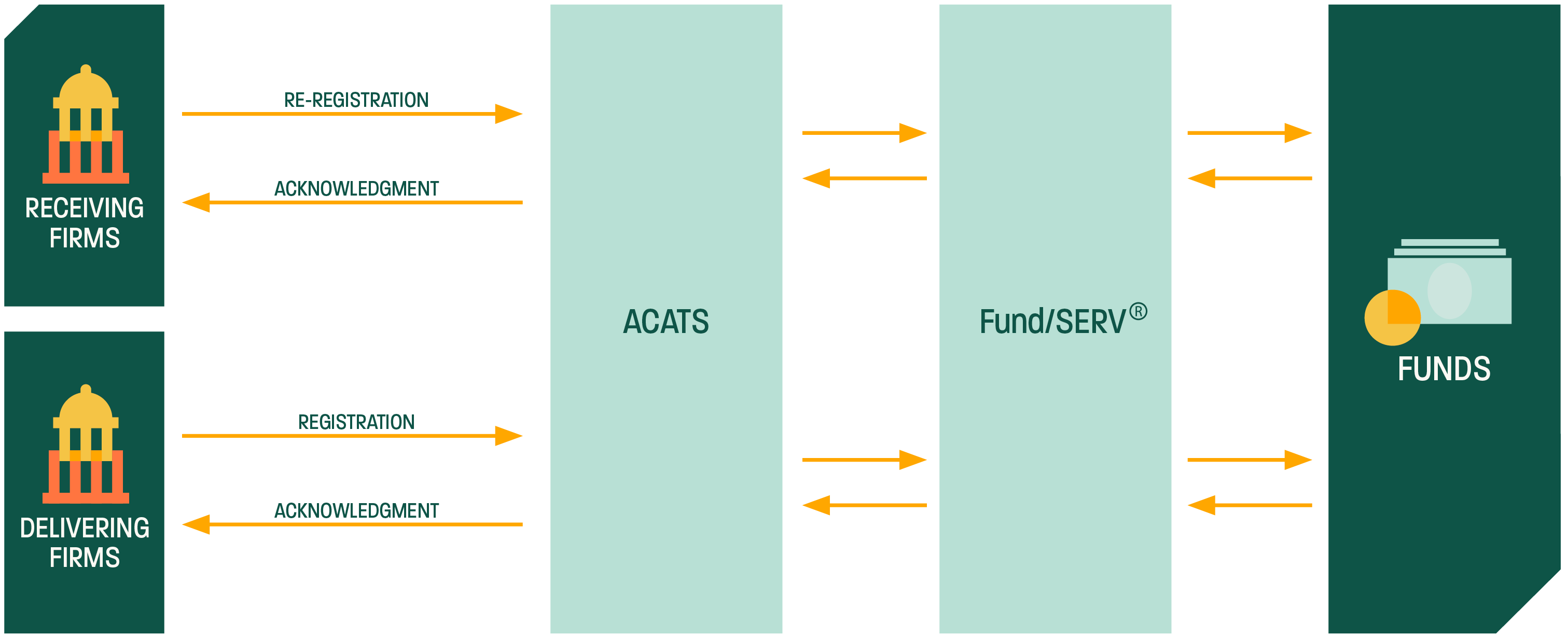

Delivering firms must submit asset details or reject the transfer. Asset details that are submitted by the delivering firm are reported by NSCC to the delivering and receiving firms. Receiving firms have one business day to accept or reject the account, or request that the delivering firm make adjustments. During this one-day period, delivering firms can add, delete or change an item. Receiving firms can delete mutual funds when they have no selling agreement with the fund. ACATS-Fund/SERV is then used to communicate mutual fund asset transfer information to the appropriate fund.

Firm-to-Firm Transfer:

For broker-to-broker transfers only:

On settlement date, NSCC automatically debits the delivering broker with the value of the assets being transferred and credits the receiving broker with the same amount. When the fund acknowledges, NSCC will credit the delivering broker with the value of those assets and debit a corresponding amount to the receiving broker. Throughout the process, transfers can be tracked through status reports to brokers and funds. (Note: Credits and debits are not posted to the deliverer or receiver if either party is a bank). Participant-specific defaults are available via the ACATS default registration form.

Fund-to-Firm Transfer: