DTCC subsidiaries National Securities Clearing Corporation and Fixed Income Clearing Corporation deliver highly efficient clearing services across the U.S. equities and fixed income markets, reducing risk and cost for clients, while ensuring safety and reliability in the marketplace.

DTCC, which clears and settles virtually all broker-to-broker equity, listed corporate and municipal bond and unit investment trust (UIT) transactions in the U.S. equities markets, continued to advance initiatives and drive development of new products and services in 2012.

The most significant of these initiatives was DTCC's leadership in commencing an industrywide discussion over shortening the settlement cycle for U.S. equity trades. DTCC, with the guidance of the Securities Industry and Financial Markets Association (SIFMA), commissioned an independent study, conducted by Boston Consulting Group (BCG), to analyze the potential impacts of accelerating settlement from the current T+3 to T+2, T+1 or T+0. The study examined three of the financial industry's critical areas of concern – reducing risk, optimizing capital and reducing costs.

The study results indicated that shortening the time period between trade execution and settling payment for U.S. cash securities transactions could potentially reduce the industry's costs and risk exposure by several hundred million dollars annually.

DTCC collaborated with market participants, trade associations and regulators to enlist feedback to assess results and determine next steps, if any, to be taken. In 2013, DTCC plans to put forth a recommendation based on this outreach.

Also in 2012, DTCC continued converting markets and member firms to the redesigned Universal Trade Capture (UTC) platform, which has streamlined equities clearing by capturing and reporting data in real time. The new capabilities offered by UTC are helping firms achieve risk reduction, cost savings and standardization by consolidating the four legacy trade capture systems into a single validation and reporting engine.

The focus for UTC was onboarding markets to the FIX (Financial Information eXchange) infrastructure and helping clients with a seamless transition from the traditional batch-file processing to real-time messaging. It is expected that all major markets and member firms will complete conversion to UTC before the end of the third quarter 2013.

DTCC also took steps in 2012 to further reduce the risks and costs associated with broker-to-broker ex-clearing trades and other open failed obligations (which are confirmed outside DTCC) by designing enhanced functionality for the Obligation Warehouse (OW).

The OW is a central repository for open broker-to-broker obligations that strengthens systemic risk management by giving firms and regulators a more comprehensive view of these obligations in the U.S. marketplace. The new OW tools, scheduled for rollout in 2013, will improve the client's experience with the service's Web interface.

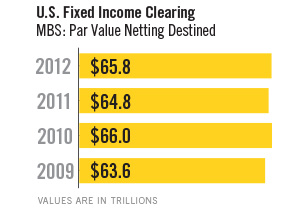

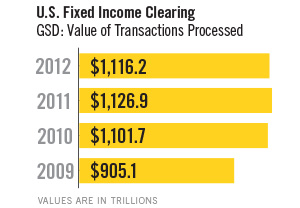

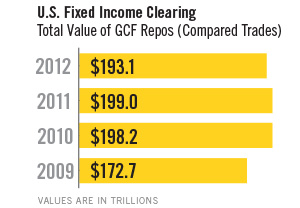

DTCC, which processes about $4 trillion each day in U.S. government and mortgage-backed securities (MBS) transactions, achieved two major milestones in fixed income clearing in 2012 – beginning with the groundbreaking launch of a central counterparty (CCP) for MBS trades. This is the first CCP to be created in U.S. cash markets in more than a quarter-century.

The new CCP, which guarantees settlement of all matched MBS trades, reduces risk and costs in the $100-trillion-a-year U.S. market for MBS. The guarantee ensures trade completion, even if one of the trading parties defaults on its initial trade commitment or pool delivery obligation. As of Dec. 31, 2012, the MBS CCP had achieved an average 50% reduction in the mortgage securities pools and payments involved in settling the trades, and reducing the costs and operational risks in this market.

In 2013, DTCC will continue to collaborate with the industry to identify ways to further mitigate risk and lower costs, while helping firms adapt to a new regulatory landscape with timely, innovative and cost-effective solutions.

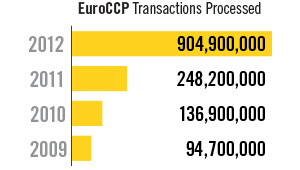

European Central Counterparty Limited (EuroCCP), DTCC's European subsidiary, has established a reputation for boldness and innovation since entering the fragmented European market for equities clearing in 2007. It has played a major role in driving down the region's risks and costs, while bringing competition to equities clearing. Today, EuroCCP clears trades from 19 markets and its services cover three asset classes: equities, exchange-traded funds and depositary receipts.

By the end of 2012, EuroCCP had become Europe's leading equities central counterparty (CCP), clearing more than 25% of all transactions executed on the region's trading venues. EuroCCP provides clearing services for nine trading and matching platforms, following the 2012 additions of Burgundy, a Nordic exchange, and Equiduct, a pan-European trading venue.

EuroCCP is widely recognized as the industry leader on interoperability, an arrangement that enables firms to consolidate the clearing of trades with the CCP of their choice. Interoperability offers firms multiple advantages, including capital efficiency and risk reduction. This concept achieved a breakthrough with EuroCCP's successful launch of four-way interoperability in January 2012. By year-end, five of the nine trading and matching venues cleared by EuroCCP were also served by at least one other CCP that interoperates with EuroCCP.

Thanks to the freedom of choice afforded by interoperability, a large number of key market participants have consolidated their activity with EuroCCP, which resulted in EuroCCP tripling its clearing volumes in 2012. On venues cleared by multiple CCPs, EuroCCP has achieved a 59% market share for trades executed.

For the third consecutive year, EuroCCP won the Financial News award for Best Clearing House Europe, receiving the highest score among five European CCPs nominated by an independent panel of 50 industry leaders and experts. The award also recognized four-way interoperability as the year's Best New Clearing Initiative.

EuroCCP has earned a reputation for the quality of its client service. For the third year running, the company received a 100% score in customer satisfaction in its annual customer survey.

New York Portfolio Clearing, LLC (NYPC), a derivatives clearinghouse owned equally by DTCC and NYSE Euronext, continued to deliver market-leading innovative solutions in 2012.

In July 2012, NYPC, in conjunction with the NYSE Liffe U.S. futures exchange, added to its interest rate product suite the award-winning Futures on the DTCC GCF Repo Index®. Futures on the DTCC GCF Repo Index won the 2012 award for "New Contract of the Year" in Interest Rates by Futures and Options Week (FOW) Magazine. Then in December 2012, NYPC brought increased capital efficiencies to market participants by adding Futures on the DTCC GCF Repo Index into the one-pot cross-margining arrangement between NYPC and DTCC's Fixed Income Clearing Corporation (FICC).

In August 2012, NYPC also expanded its "one-pot" cross-margining platform to a larger pool of market professionals, following approval from the Commodity Futures Trading Commission and the Securities and Exchange Commission.

NYPC, LCH.Clearnet, DTCC and NYSE Euronext also announced plans in 2012 to expand the existing one-pot cross-margining arrangement to include interest rate swaps cleared by LCH.Clearnet. The goal is to deliver greater capital efficiency to market participants by combining NYSE Liffe U.S.-traded interest rate futures contracts cleared by NYPC, fixed income cash and repo trades cleared by FICC, and interest rates swaps cleared by LCH.Clearnet's SwapClear service into a single portfolio for purposes of margin netting and offsetting.

To oversee the continued expansion of NYPC, Sandy Broderick was named CEO in 2012, bringing a unique blend of expertise in risk management, technology and clearing for over-the-counter and listed future products. Broderick came to NYPC from Société Générale, where he was head of GBP derivatives and bond trading.