DTCC's Data and Repository Services is focused on working with the industry, regulators and DTCC counterparts to create capabilities that leverage data in order to mitigate risk, enhance transparency and drive down costs in financial markets globally.

In 2012, DTCC significantly expanded the Global Trade Repository (GTR) in order to support mandatory regulatory reporting requirements for over-the-counter (OTC) derivatives. The GTR, which holds detailed data on OTC derivatives transactions globally, gives market participants and regulators an unprecedented degree of transparency into this US$650 trillion market – an essential tool for managing systemic risk.

GTR is now established as the industry's preferred provider for global OTC derivatives reporting. As of year-end 2012, it holds data on more than 98% of credit default swaps, 70% of interest rate derivatives and 60% of equities derivatives traded globally – and it is expanding to include foreign exchange and commodities derivatives.

The GTR's Regulators Portal, which provides detailed information on counterparty positions as well as notional and transaction-level data, was leveraged on a regular basis by more than 40 supervisors globally throughout 2012 to help them manage sovereign debt crises, corporate failures, credit downgrades and significant losses by financial institutions. The portal is the first global service of its kind in the financial marketplace to provide regulators with granular data on transactions that occur within their jurisdictions.

DTCC significantly extended the GTR business in 2012 and early 2013, incorporating companies to serve as trade repositories in the U.S. and Japan, with plans to apply for registration as a trade repository in the U.K. this year. DTCC also completed the final leg of its strategy to establish a global trio of fully replicated GTR data centers in The Netherlands, Singapore and the U.S. This geographically dispersed model helps ensure local markets and regulators have access to their data and oversight of it, while strengthening business continuity across the market globally. In addition, DTCC expanded the GTR Account Management team to provide broader coverage to clients in Europe and the Far East.

In Asia, DTCC has spent the past several years establishing its footprint given the region's important share of the global OTC derivatives market. In 2012, DTCC opened GTR's Asia-Pacific data center, headquartered in Singapore, and created operations and client support functions in Singapore and Japan to better service the Asia-Pacific region. In March 2013, the company received approval from the Japan Financial Services Authority to establish a Japanese OTC derivatives trade repository. Based in Tokyo and operated by the DTCC Data Repository (Japan) KK (DDRJ) subsidiary, this is the first trade repository to be approved and established for the Japanese market.

In 2013, DTCC anticipates making additional applications for registration as a trade repository pending finalization of legislation and regulations in other Asia-Pacific markets, such as Singapore and Australia. In Hong Kong, DTCC plans to send data, as a third-party agent, to the Hong Kong Monetary Authority on behalf of DTCC participants with reporting obligations.

To support U.S. Dodd-Frank Act requirements in the U.S., DTCC applied for and received provisional registration from the Commodity Futures Trading Commission (CFTC) to operate a multi-asset-class swap data repository (SDR) for OTC credit, equity, interest rate, foreign exchange and commodity derivatives in the U.S. Former CFTC Acting Chairman Michael Dunn was also brought on board to serve as the nonexecutive chairman. DTCC began accepting trade data from its clients on Oct. 12 – the first day that financial institutions began trade reporting under Dodd-Frank. Furthermore, on Dec. 31, DTCC was the first and only organization to offer real-time price dissemination.

In 2013, DTCC will continue to work with market participants and regulators to extend the reach of GTR globally and by asset class. Foremost among these efforts, GTR plans to register as a trade repository with the European Securities and Markets Authority in order to support regulatory reporting required by the European Market Infrastructure Regulation. The ultimate aim is to help regulators around the world manage systemic risk by providing near-real-time access to OTC derivatives data from a single comprehensive source and to give market participants the ability to meet reporting requirements in multiple jurisdictions using one system.

DTCC's legal entity identifier (LEI) solution, developed in conjunction with SWIFT, is enabling the industry to solve a long-standing problem: how to standardize the identification of legal entities that engage in financial transactions and make the data readily accessible.

The push for a solution gained momentum in the wake of the 2008 financial crisis as it became clear that this information is a critical tool for helping regulators and market participants understand exposures, enhance market transparency and manage systemic risk.

Against this backdrop, DTCC and SWIFT joined forces to create a global LEI data management system that is available to regulators and the industry globally. The system was formally endorsed by the Global Financial Markets Association, a consortium of 14 global financial services industry organizations.

The LEI solution assigns unique identifiers in a standard format. The system validates the accuracy of the associated reference data and stores all the information in a public database free for all to use and redistribute. In 2012, financial institutions began using the database, initially to identify parties to over-the-counter (OTC) derivatives trades across markets and jurisdictions.

In 2012, DTCC and SWIFT leveraged the existing LEI solution to build a new database, known as the CICI Utility (the Commodity Futures Trading Commission or CFTC Interim Compliant Identifiers), to help firms comply with global swap data reporting regulations, the first of which became effective in October. DTCC and SWIFT were selected by the U.S. CFTC to launch this utility, which assigns CFTC identifiers to swap dealers and major swap market participants registered with the agency, and to their counterparties around the world. These identifiers are required for recordkeeping and data reporting in this complex asset class.

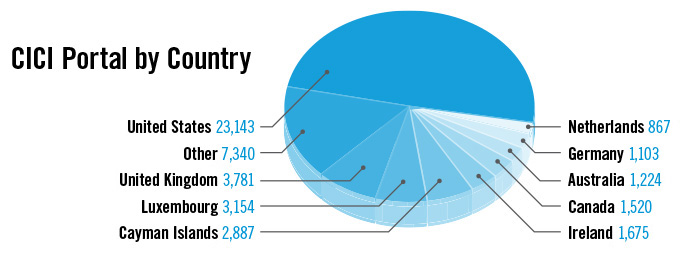

When the CICI Utility went live in August, it had more than 24,000 legal entities preloaded into the database with their reference data validated. As of January 2013, more than 47,000 entities from 125 countries were registered.

DTCC and SWIFT designed the LEI solution to meet global requirements – across asset classes – set by the industry under the auspices of the Global Trade Associations Group, led by the Global Financial Markets Association.

The solution is built on a flexible infrastructure that can be easily adapted to meet evolving industry and regulatory requirements globally. For example, as the CICI Utility was under development, the Financial Stability Board (FSB) published its recommendations for structuring a global LEI system, which included a federated registration model, a focus on self-registration and a structured 20-character alphanumeric code based on the International Organization for Standardization (ISO) 17442 LEI Standard. DTCC/SWIFT quickly updated the CICI Utility to meet these guidelines so that all existing records can ultimately transition to the global LEI solution without change.

DTCC continues to work closely with the industry's LEI Steering Committee, the FSB Private Sector Participatory Group, SWIFT, the CFTC and other global regulators in the FSB's Implementation Group to gain consensus on the design and implementation of a universal LEI solution.

In the meantime, the CICI Utility is bringing a new level of transparency and risk management to the OTC derivatives markets. It is also a prototype that can be leveraged by regulators and market participants in other asset classes to better manage risk and exposures on a global scale.

Another major development was the growth of the DTCC GCF Repo Index®, which gained significant traction in 2012. DTCC created this unique index to improve transparency and liquidity in the U.S. funding markets. It tracks the average daily interest rate paid on overnight transactions in the US$400 billion daily market for general collateral finance repurchase (GCF Repo®) agreements. Because the GCF Repo Index is based on actual transactions processed by DTCC, it is a more accurate reflection of funding costs than benchmarks that are based on estimates.

Starting in January 2013, DTCC GCF Repo Index data for the U.S. Treasury and MBS is published daily in The Wall Street Journal's "Money Rates" table in both the print and online publications.

Additionally, in July 2012, NYSE Liffe U.S., the U.S. futures exchange of NYSE Euronext, launched a new futures contract based on the DTCC GCF Repo Index. Since then, more than 400,000 total contracts valued at more than US$2 trillion have been traded.

In 2012, DTCC expanded the Analytic Reporting for Annuities service, which differentiates itself from competitors by mining real transaction data in annuities instead of survey data to provide clients with the most accurate market analysis, trends and benchmarking. DTCC introduced two enhanced business intelligence features last year in response to rising industry demand:

- A new research portal gives clients unrivaled access to aggregated annuities-related transactional data delivered in various user-friendly formats, as well as a variety of new tools to assist in analysis.

- A new functionality to conduct targeted territory analysis down to the ZIP-code level enables clients to collect rankings within specific geographic markets and provides a springboard for marketing and other business decisions.

DTCC's Global Corporate Actions Validation Service (GCA VS) tracks, validates and distributes corporate actions information on 2.5 million securities globally in more than 200 countries and in 15 languages. DTCC maintains staff in New York, London and Shanghai to validate corporate actions announcements and provide timely, accurate information on the events.

The company extended the reach of GCA VS in 2012 by teaming with leading software companies that automate the processing of corporate actions information. This initiative gives customers an end-to-end solution combining GCA VS's high-quality data with state-of-the-art processing capabilities offered by multiple vendors.

Loan/SERV, DTCC's suite of services that supports the global syndicated loan market, continued to add new customers and increase the number of transactions and loans positions in 2012.

Loan/SERV Reconciliation, a service allowing agent banks and lenders to reconcile syndicated loan positions, transactions and contract information on a daily basis, now records more than 7,500 loan facilities from more than 20 countries. The service increased its customer base by more than 20% in 2012 to 4,333 banks, funds and other lending vehicles.

Loan/SERV Cash on Transfer service, the first delivery-versus-payment mechanism for the secondary loan market, saw a dramatic increase in 2012, with the number of facilities exceeding 1,400. Cash on Transfer links the buyer, seller, agent bank, trade processing platform and counterparty accounts, allowing for cash and legal ownership of the asset to move simultaneously on the agreed trade settlement date. It represents a major advance in reducing settlement risk in the loan market.

The loan trade processing platform of Markit, a global financial information services and trade processing company, is the first such platform linked to the service to automate loan trade settlement electronically.

Avox, a U.K.-based subsidiary of DTCC that validates, enriches and maintains business entity reference data for financial services firms, experienced significant year-over-year growth. The company increased the number of entities managed in its database to which a unique Avox ID, or AVID, is assigned by 25%, reaching close to 1 million by year-end. Avox validates and maintains the integrity of the entity information in its database by using sources in more than 235 jurisdictions, and updates more than 150,000 data records each week. In addition, Avox was recognized with the award for "Best Counterparty Data Provider" by Inside Reference Data in 2012 for the fourth year running.

On the heels of these successes, Avox launched its legal entity data portal (www.avoxdata.com), which provides free and unrestricted access to core data and standard industry identifiers for a global set of legal entities. In addition, it rolled out a new AvoxData Regulatory Reporting File download service to support clients with their regulatory reporting requirements with the U.S. Commodity Futures Trading Commission (CFTC).