Asset managers, banks, broker-dealers, wealth managers, and marketplace operators can tokenize assets using DTCC Digital Assets’ solutions.

DTCC Digital Assets is helping clients create and launch digital assets marketplaces that drive higher liquidity and grow new revenue streams. Its capabilities enable it to:

- Tokenize assets such as equities, fixed income, funds, and more

- Integrate with financial systems and blockchains

- Embed compliance, identity, security, transaction, and liquidity rules into the tokens themselves

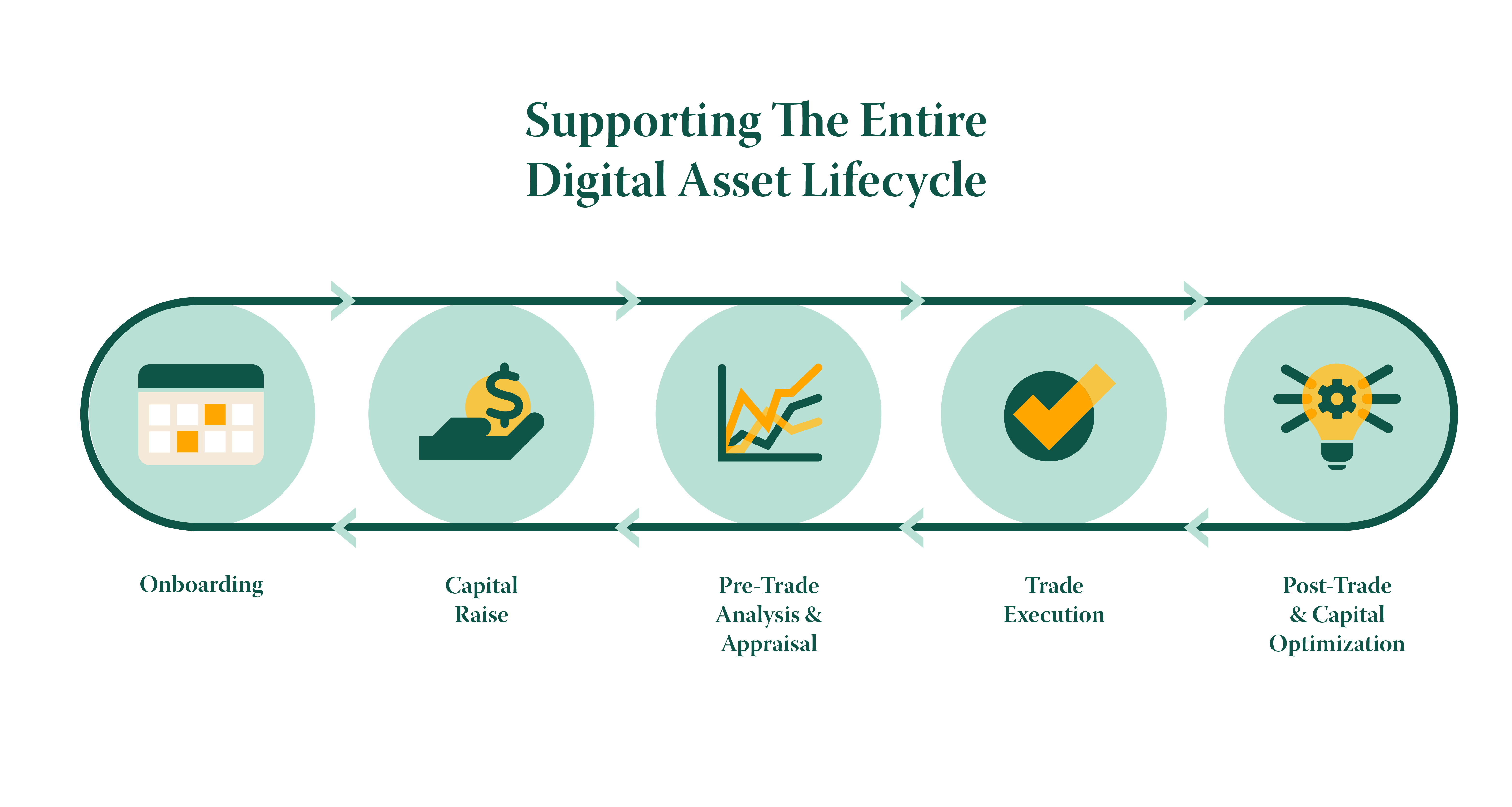

- Customize workflows and analytics to automate the digital asset lifecycle

- Provide account management and wallet services