DTCC’s Insurance & Retirement Services (I&RS) Insurance Information Exchange (IIEX), a revolutionary platform that supports insurance data on-demand, has increased data capabilities & feature functionality.

Since its production launch on January 1, more than 14.8 million policy records now reside on the IIEX platform, providing clients with data standardization and insights to promote data-driven decision making. Not only do clients using IIEX have organized data on-demand, they now also have the ultimate flexibility to access their policy data via APIs within their own technology systems.

“We believe this platform has the potential to be a real game-changer for the insurance business,” said Jamie Taylor, DTCC Director of I&RS. “We’ve partnered with clients to develop a timeline for future releases, and we’re excited to continue the evolution of IIEX.”

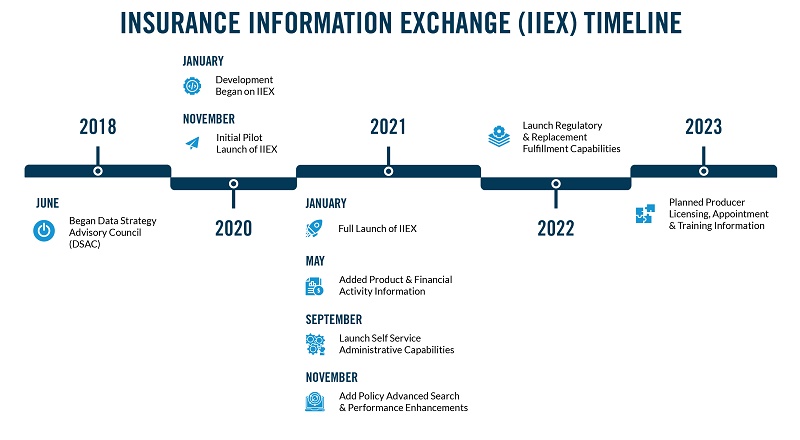

Working with a consortium of industry-leading insurance carriers and distribution partners, DTCC’s I&RS team identified the enhancements that would best benefit the insurance industry. The IIEX enhancement timeline is a constant evolution; the visual timeline displays anticipated major IIEX enhancements through 2023.

Latest Enhancements: May 2021

In May, IIEX enhancements spanned three categories: Policy-level Financial Data, Product (CUSIP) Data and Access to Fee & Expense and Commission Schedule Information.

- IIEX’s policy-level financial data was expanded to now include financial related activities – up to 10 years of historical data. Additionally, IIEX analytics have advanced to allow reports of financial transaction data and sub account information. Policy data has become easier than ever to access with Excel data downloads and API-requested data now available in IIEX.

- Product (CUSIP) data now displays the Product information summarization on more than 12,000 CUSIPs with Top 5 categories in: CUSIP Type, Product Type, CUSIP Count, etc. Product Search criteria within IIEX now includes targeted access and saved search criteria. Display Product CUSIP details are available in IIEX and can be linked to the Policy’s CUSIP Details screen. Like the policy-level financial data above, Product CUSIP data is also accessible in IIEX via Excel data download and as API-requested data.

- Through integration with I&RS’s Insurance Profile service – a platform that enables annuities distributors to access expense, fee and commission schedule data from carriers in a central location – IIEX users can access FET and CST data. IIEX easily integrates and creates access to the Fee and Expense and Commission Schedule information, which becomes viewable using a link from the Product Details screen. This increases transparency and standardization to the data exchange process.

September and November 2021 – and Beyond

November 2021 marks one year since the IIEX Pilot Program launch and will include new enhancements around Advanced Search criteria and Policy & Product features.

IIEX initiatives for 2022 include launching regulatory and replacement fulfillment capabilities. Looking even further out at 2023, DTCC’s I&RS envisions developing IIEX planned producer, licensing, appointment, and training information.

“As the insurance industry experiences digital and regulatory transformations, we look forward to continuing to shape the IIEX platform to meet the needs of the industry,” said Barb Smith, DTCC Executive Director of Insurance & Retirement Services. “DTCC’s I&RS is committed to developing IIEX’s initiatives and timeline to support the insurance industry.”

If you are interested in learning more about the Insurance Information Exchange (IIEX), please fill out a ‘Contact Us’ form or contact your relationship manager.