Supporting Replacement Processing business is not a new concept, and in fact, many firms have always manually supported replacement processing. However, firms managing these operational replacement processes manually tend to experience several inefficiencies, such as not in good order (NIGO) outcomes, delays and missed opportunities. These firms are losing time and money, but ultimately, they are providing a poor experience for their clients.

“At DTCC, we’ve had firms approach us over the years – and now especially during the recent Covid-19 pandemic – about their frustration with inefficiencies in replacement processing,” said Cory Stark, DTCC Senior Product Management Director for Insurance & Retirement Services (I&RS). “With our clients’ continual guidance and industry leadership, DTCC’s I&RS has evolved the replacement process with an added level of automation.”

Automation in Replacement Processing

For the past year and a half, the Covid-19 pandemic has caused a significant shift to virtual workplaces – making manual replacement processing more challenging than usual. DTCC’s Replacement Processing automation supports accurate, timely electronic communication between receiving and ceding carrier partners to meet the distributor’s request for replacement new business.

For the past year and a half, the Covid-19 pandemic has caused a significant shift to virtual workplaces – making manual replacement processing more challenging than usual.

Two services particularly support Replacement Processing automation: Settlement Processing for Insurance (STL) and Attachment Processing (ATT).

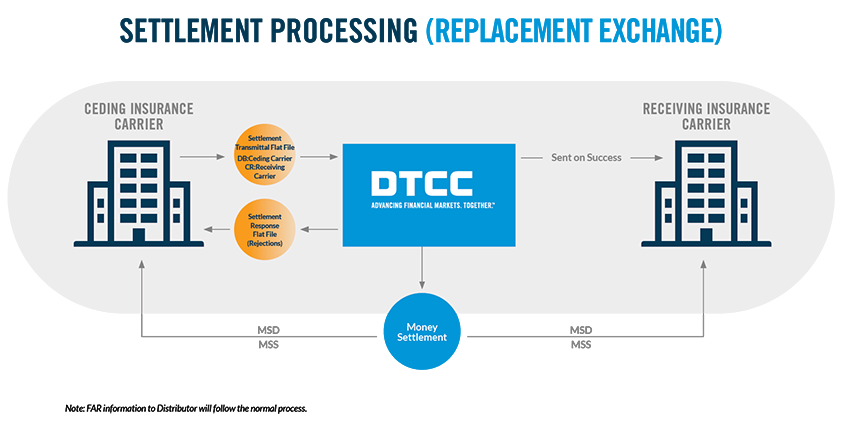

Settlement Processing for Insurance℠ Supporting Replacements

Settlement Processing for Insurance℠ (STL) replaces slow and costly settlement processes with a streamlined, automated tool that brings unmatched value to clients and the insurance industry. Clients gain an edge with faster settlement of funds, fewer rejections, and lower costs – directly contributing to an enhanced financial advisor and end-customer experience.

Using STL to support replacement business expedites the movement of monies between ceding and receiving carriers. STL supporting replacements is a stand-alone, credit only service (initiated by the ceding carrier) that utilizes standard record layouts through NSCC and is available to firms that are settlement eligible members of NSCC. STL helps reduce back-and-forth communication and NIGO rates for replacement settlement activity.

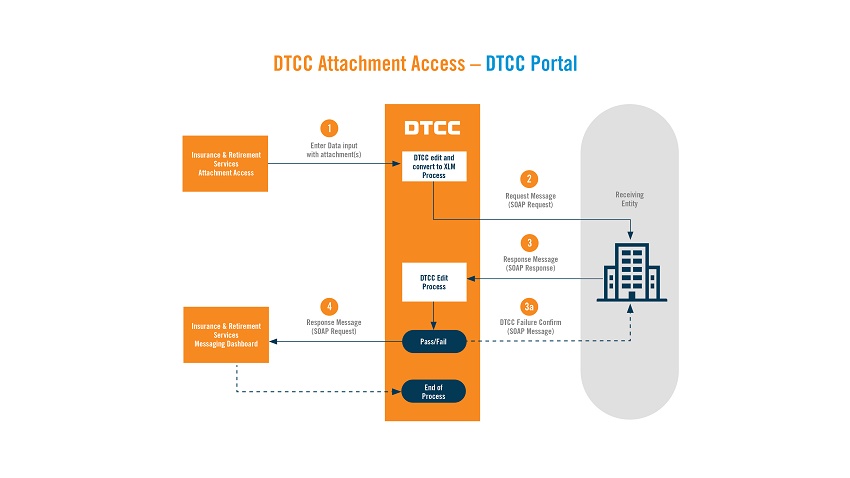

Attachment Processing Supporting Replacements

Attachments Processing and Attachment Access Supporting Replacements (ATT) service is the real-time transmission of replacement supporting documentation to facilitate the replacement request from receiving carriers to ceding carriers. Confidential documentation items in ATT are in industry-approved, standardized formats and are securely transferred to and from DTCC. Some of the items electronically exchanged in ATT are digital documents, signatures, forms, and other types of unstructured data during pre-sale, new business and post-issue processing of annuity and life insurance information. ATT is a stand-alone service that includes a comprehensive audit trail and is available to NSCC members.

Through real-time transmission in a standardized, centralized, and secured service, firms using ATT eliminate the need for hard copy mail exchanges. ATT supports firms’ savings through reduced mailing and courier costs, faster delivery times, and the reduced potential for incorrect delivery locations. Additionally, the ATT service not only enhances the client experience, but it also creates opportunities and efficiencies for carrier partners to expedite the exchange supported documentation.

“We are excited to have these replacement processing services available for our clients and we look forward to continuing to demonstrate all the efficiencies replacement processing has to offer,” said Stark.

STL & ATT services are available independently, but both processes support replacement processing automation and can be used together.

For more information on Replacement Processing, contact your Relationship Manager or fill out a contact us form.