In April, DTCC announced the development of a prototype, known as Project Lithium, that will be the first to measure the benefits of a central bank digital currency (CBDC) and inform the future design of the firm’s clearing and settlement offerings.

DTCC Connection sat down with Jennifer O’Rourke, DTCC Director of Innovation Strategy & Design, to gain more insight on how CBDCs fit within the rapidly evolving digital currency space.

Related: Find Out How We're Driving Innovation with Purpose

DC: Can you provide a basic overview of the different types of digital currency?

JO: You can differentiate the different forms of digital currency based on how it’s backed. Here’s a real high-level outline:

- Cryptocurrency: Many are familiar with this form of digital currency. This type leverages cryptographic and distributed ledger technologies to provide a foundation for decentralized, peer-to-peer payments. It is not backed by any physical asset – it is entirely digital

- Stablecoin: These are cryptocurrencies that are pegged to an external asset such as fiat. (Fiat money is not back by any commodity, like gold or silver.)

- Central Bank Digital Currency (CBDC): This type is a digital form of a nation’s currency, backed and issued by a central bank.

DC: Specific to CBDCs, is it one-size-fits-all approach or are there different variations?

JO: Within the CBDC space there are two different categories: retail and wholesale. A retail CBDC is used by individuals as a form of cash, backed by a central bank. A wholesale CBDC is utilized by financial institutions. For this conversation we’ll focus on CBDCs from a wholesale perspective.

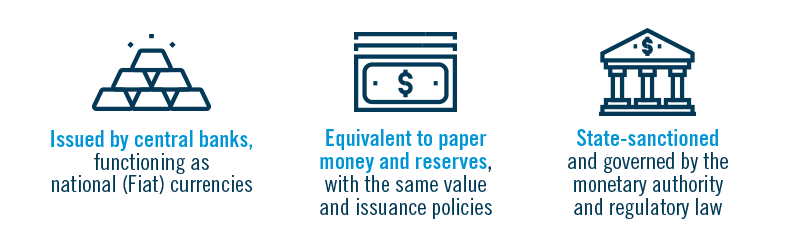

CBDCs could be different depending on the specific approach. It can be issued by central banks, functioning as a national currency. They can be equivalent to paper money and reserves, with the same value and issuance policies. CBDCs can also be state sanctioned and governed by the monetary authority and regulatory law.

DC: What are the potential benefits of a CBDC?

JO: Central banks and others are exploring both the potential benefits and challenges posed by CBDCs. CBDCs have the potential to address a range of current pain points in the payments system for retail and wholesale markets.

The potential value drivers of a retail CBDC include an around-the-clock retail payment system, greater financial inclusion for individuals with limited access to the banking system, and alternative disbursement of government funds.

Since many financial institutions have access to "electronic reserves" or account balances held at applicable central banks, a CBDC could provide benefits such as improved efficiency for cross-border payments, 24/7access to payment systems, the potential for a reduction in settlement and counterparty risks. In addition, a CBDC could potentially provide atomic settlement, a conditional settlement that occurs if delivery and payment are both received at the same time.

Alongside the benefits of CBDCs, central banks are also evaluating design elements and considerations which may pose challenges to operational resiliency due to cybersecurity attacks and have monetary policy implications as result of undesirable volatility in Forex rates, “digital dollarization” for other countries, and an unintended loosening of monetary policy oversight by domestic authorities.

DC: How are central banks approaching CBDCs?

JO: There is no one-size-fits-all approach to central banking and the same is true for CBDCs. Banque de France’s Project Jura which explores delivery versus payment (DvP) and payment versus payment (PvP) mechanisms, Hong Kong Monetary Authority, Bank of Thailand, and Central Bank of the UAE’s mBridge Project which explores multi-CBDC cross-border payments and China’s E-CNY pilot of a retail CBDC, illustrate the various ways in which CBDC are being explored with diverse design considerations.

However, there is an opportunity to develop standards and best practices to ensure successful and safe adoption and implementation. The Fed recently outlined that a potential U.S. CBDC, if one were created, would best serve the needs of the U.S. by being privacy-protected, intermediated, widely transferable, and identity-verified.

DC: What should we expect as a next step regarding Project Lithium and CBDCs?

JO: Central banks and policymakers will continue to uphold core objectives such as risk mitigation and consumer protection while encouraging innovation. This balanced approach is underscored when considering potential CBDCs, given the significant impact this innovation could have on firms, markets, and individual investors.

With DTCC's Project Lithium prototype, we aim to identify how it can leverage our robust clearing and settlement capabilities to fully realize the potential benefits of a CBDC, including:

- Reduced counterparty risk and trapped liquidity

- Increased capital efficiency

- A more efficient, automated workflow

- The guarantee that cash and securities are delivered

- Added transparency to regulators

DTCC is developing its Project Lithium pilot in collaboration with The Digital Dollar Project (DDP), a non-profit led by former U.S. regulators, renowned tech leaders and executives from the consulting firm Accenture. With initial funding from Accenture, DDP is facilitating a series of retail and wholesale pilots to evaluate how a central bank-issued currency might work across U.S. financial infrastructure and the American social landscape.