For the past decade, financial firms have experienced waves of new and revised regulations around transaction reporting. And more changes will be rolling in over the next few years as nearly all jurisdictional rules for derivatives trade reporting undergo rewrites to adopt industry-recommended standards.

In short, compliance with reporting regulations has become a moving target. The ordinary challenges of reporting data accurately and efficiently to regulators are compounded by the uncertainty of what new and revised rules will require.

With their regulatory reporting teams facing a staggering workload in 2021 and beyond, firms need to consider how they will adapt their reporting protocols and infrastructure to this environment. Trade reporting systems built in response to the 2008 financial crisis – whether in-house or outsourced to specialized third-party vendors – deserve a hard look because, for many firms, they may no longer be adequate to handle today’s growing regulatory challenges at a cost that is sustainable.

The time is ripe for a new model: single-vendor solutions with comprehensive jurisdictional and regulatory coverage. Such solutions support trade repository (TR) and approved reporting mechanism (ARM) submissions and reconciliation by facilitating a variety of pre- and post-reporting activities and keep pace with global rule changes.

DTCC, the world’s leading provider of post-trade processing services, is advancing this new model with its DTCC Report Hub® service. Launched in early 2020 and expanded in December 2020 with DTCC’s acquisition of the Compliance Management Reporting System platform (CMRS) from Publicis Sapient, DTCC Report Hub enables firms to manage their global derivatives, Markets in Financial Instruments Directive II (MiFID II) and Securities Financing Transactions Regulation (SFTR) pre- and post-trade reporting requirements with a single-vendor solution.

Compliance Challenges

Among the regulations resulting from the 2008 financial crisis were reporting mandates for derivatives transactions. Jurisdictions rolled out their respective rules at different times and without close coordination. The result: many differences in reporting formats, trade data elements and other parameters – which are now triggering a new round of rule revisions aimed at increasing standardization across jurisdictions.

This post-crisis global regulatory surge and ongoing failure to harmonize rules from one reporting regime to another has necessitated continual modifications to firms’ technology platforms. After a decade of patches to accommodate one new rule or update after another, the trade processing and reporting infrastructure in most firms today is duplicative and inefficient.

For firms that have developed their own pre- and post-reporting capabilities, the upcoming rewrites of derivatives rules – which will include adoption of Common Data Elements (CDE) and Unique Product Identifiers (UPI) for reporting – will spur yet more updates to their infrastructure and further burden its already-stressed capacity and functionality.

Evolving regulatory provisions will also necessitate ongoing refinements to firms’ data management and messaging processes. For example, if, as expected, regulators adopt the ISO 20022 message scheme for derivatives CDE, trade data will need to be normalized to meet this new standard – tedious work that many firms will likely need help completing.

The strain on internal staff, processes and platforms caused by ever changing regulations have led some firms to turn to one or more third-party solutions providers to deliver discrete pre- and post-reporting functionality. But the result can be a patchwork of solutions that are not integrated with one another and require multiple connections.

Furthermore, use of solutions from different providers can deprive firms of the comprehensive, cross-jurisdictional regulatory coverage they need to manage pre- and post-reporting activities for all reporting regimes, each of which has varying rules. Without a unified solution firms could face increased compliance risk and cost.

Streamlining Pre- and Post-Reporting Workflows with a Unified Solution

Given the trade reporting challenges ahead – including the continuing, regime-specific changes to derivatives mandates, the complexity of SFTR reporting and the sheer difficulty of managing trade reporting across multiple asset classes and jurisdictions – a unified, single-vendor suite of services like DTCC Report Hub can help firms mitigate risk, enhance operational efficiencies and reduce costs associated with regulatory reporting compliance.

For firms that have solutions developed in-house, a move to DTCC Report Hub frees up staggering amounts of staff time and internal resources. And DTCC Report Hub’s single-vendor model provides the consistent, streamlined functionality that is generally missing when firms utilize multiple vendors.

DTCC has extensive experience providing TR services, having brought the first TRs to market in 2012 and subsequently launching licensed/registered TRs in key markets around the world as part of DTCC’s Global Trade Repository service (GTR). As it navigated the evolving trade reporting landscape over the past decade, DTCC came to recognize that firms today could greatly benefit from access to a comprehensive suite of pre-and post-reporting capabilities as well as tools to simplify reporting transactions across jurisdictions and asset classes.

This deep understanding of the trade reporting ecosystem helped inform the development of DTCC Report Hub. DTCC Report Hub facilitates pre- and post-reporting activities for SFTR and now, with the acquisition of CMRS, for derivatives and Markets in Financial Instruments II (MiFID II) as well.

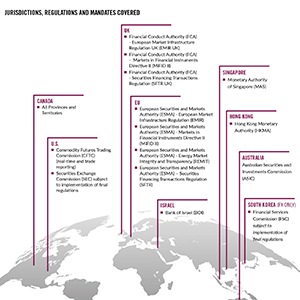

The expansion of the DTCC Report Hub platform through the CMRS acquisition is a game changer for pre- and post-trade reporting services. By delivering a unified, single-vendor pre and post reporting platform, firms can consolidate reporting activities for multiple jurisdictions – US, UK, Europe, Canada, Israel, Singapore, Australia and Hong Kong – and be prepared for forthcoming rule additions and changes. This breadth of coverage can help firms maximize their operational efficiencies and compliance-risk mitigation, reduce costs and free-up staff to focus on other priorities.

With its extensive suite of pre-reporting services, DTCC Report Hub streamlines the complex workflows required to prepare trade data for submission to TRs or ARMs. Starting with data normalization and transformation – including to accommodate the ISO 20022 messaging scheme – this suite provides data enrichment, jurisdictional eligibility analysis, a customizable rules engine and advanced exception management and reprocessing.

DTCC Report Hub’s delegated reporting capabilities enable users to submit trades on behalf of clients once they have established the applicable permissions at the receiving TR. Where a DTCC Report Hub user has delegated its reporting obligation for certain trades to another firm, DTCC Report Hub will identify and automatically suppress the reporting of such trades by the DTCC Report Hub user.

Closing the Reporting Loop

In addition to interfacing with TRs and ARMs to facilitate trade submissions, DTCC Report Hub also delivers the post-reporting functionality. Its reconciliation tool applies reporting completeness and accuracy checks on TR end-of-day reports against a client’s internal systems. DTCC Report Hub can also provide extensive data analytics to help firms better manage reporting completeness, accuracy and timeliness.

Even with a solution like DTCC Report Hub, firms would still need to keep pace with global regulatory output by having up-to-date reporting processes, controls, systems and governance. Firms that have repeatedly modified their infrastructure in response to new and revised mandates may need a top-to-bottom overhaul if they are to manage regulatory reporting risk in a cost-efficient manner. DTCC can help firms analyze their infrastructure performance and data quality and assist them in evaluating whether certain enhancements or redesigns are warranted.

Firms can leverage DTCC Consulting Services to gain a better big picture understanding of where opportunities may lie to align transaction reporting and control frameworks with the global trend toward regulatory standardization. DTCC Consulting teams can help firms undertake strategic evaluations as well as assist with tactical projects, such as simplifying data sets, upgrading data element sourcing related to collateral and unique identifiers, designing new or upgrading existing performance and data-quality monitoring systems.

Today’s formidable global trade reporting challenges demand comprehensive solutions. By partnering with DTCC, firms will have access to a wide array of tools and services that can help meet these challenges.