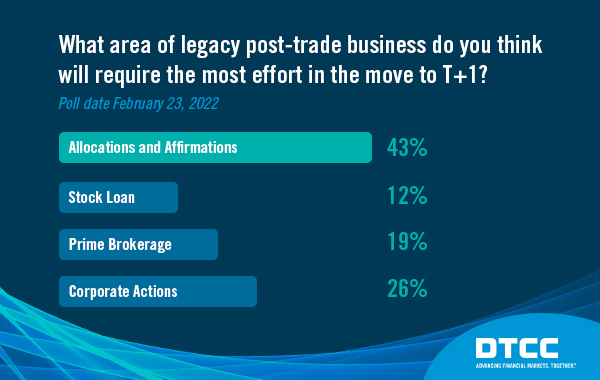

It is not surprising that the greatest number of respondents (43%) to a recent LinkedIn poll hosted by DTCC voted “allocations and affirmations” as the process area that would require the most transformation as firms begin to prepare for a move to T+1.

Related: Applauding the SEC’s Proposal to Accelerate the Settlement Cycle to T+1

Allocations, confirmations and affirmations are critical post-trade functions. The Allocation process occurs when an Investment Manager sends instructions to its Broker on how to allocate a block trade to underlying client funds. Once the Allocation has been completed, the Confirmation and Affirmation process occurs, providing a detailed record of a transaction. This is essentially when the details of a transaction are finalized, and includes key information such as what was traded, the date that the trade occurred, and the cost and net value of the trade. Without these processes, the transaction cannot be easily cleared and settled.

As firms turn their attention to preparing for T+1, the focus is squarely on further automating their post-trade processes, an area that has traditionally taken a back seat to front office operational investment. Specifically, firms are focusing on the achievement of “Same Day Affirmation” (SDA) – or affirming an institutional transaction the day it is executed. A spotlight has been shone on the importance of efficiency in these post trade processes in the SEC’s recently proposed rules to shorten the settlement cycle to T+1 for securities transactions, which states that in order to achieve T+1 settlement, it is required that trades be allocated, confirmed, and affirmed as soon as technologically practicable and no later than end of trade date.

The good news is that automated institutional trade processing solutions already exist and can help market participants achieve SDA. DTCC’s CTM solution offers the Match to Instruct (M2I) workflow that automatically triggers trade affirmation and delivery to DTC for settlement when a centrally matched trade between an Investment Manager and Executing Broker occurs, eliminating the need for either party to take further action. Clients using this workflow today are achieving a near 100% affirmation rate by 9 PM on trade date, demonstrating that the adoption of the workflow is a critical enabler of settlement efficiency and ultimately achieving T+1 timelines.

Reach out to your DTCC relationship manager today to explore how advanced automation in post-trade processing via CTM can propel efficiency as firms set their sights on T+1.