It is increasingly clear that blockchain technology is likely here to stay, with 97% of institutional investors anticipating tokenization will evolve asset management processes and $100 trillion worth of assets in the U.S. that could someday move onchain. Rather than embarking on a wholesale rebuild of existing capital markets infrastructure, financial institutions are increasingly collaborating with innovative Web3 technology platforms like Chainlink to explore how capabilities can be embedded into their existing systems where possible to accelerate the real-world impact of blockchain technology in the global financial system. Our exploration in this space started with our collaborative work with Chainlink as part of Swift’s interoperability project.

DTCC and Chainlink Collaborate on Swift’s Blockchain Interoperability Project

As a premier financial market infrastructure provider, DTCC automates and standardizes the processing of financial transactions, mitigating risk, increasing transparency, enhancing performance, and driving efficiency for thousands of broker/dealers, custodian banks, and asset managers around the world. One of the cornerstones of success for DTCC and other major financial market infrastructure providers (FMIs) like Swift has been the establishment of industry standards that allow a multitude of financial institutions operating on disparate systems and in different jurisdictions to conduct business in a secure and efficient manner.

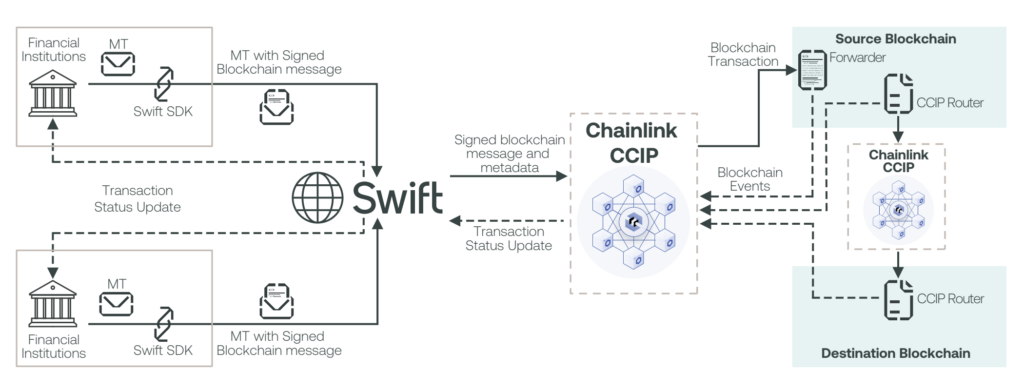

Swift’s project explored standardization in blockchain interoperability, by showcasing how financial institutions and FMIs can utilize their existing Swift connection in combination with Chainlink to instruct the transfer of tokenized assets across public and private blockchains. Chainlink CCIP was used on the backend by Swift to facilitate secure cross-chain messaging and token transfers, while DTCC served as a token issuer and central securities depository (CSD). More specifically, DTCC minted and issued ‘BondTokens’ compatible with Chainlink CCIP and distributed them to Swift’s designated test wallets. Explore the Swift interoperability project in more detail in the new report, “Connecting blockchains: Overcoming fragmentation in tokenized assets.”

Our involvement in Swift’s blockchain interoperability project underscores our commitment to staying at the forefront of FMI innovation and creating new opportunities for our clients to optimize their financial operations and achieve new value via digital technologies.

Overview of how Chainlink CCIP interfaces with existing Swift infrastructure to orchestrate the secure transfer of tokens across blockchain networks.

Chainlink CCIP facilitates the secure transfer of tokens across blockchain networks.

Chainlink CCIP facilitates the secure transfer of tokens across blockchain networks.

Unlocking Capital Markets Interoperability

In recent years, it has become increasingly clear that FMIs like DTCC can play key roles in delivering robust connectivity to and across blockchains. Our desire to explore this capability led to a series of conversations with the Chainlink Labs team around how CCIP could potentially serve as a universal gateway for interacting with blockchains for new and existing backend systems. Following the successful collaboration on the Swift project, DTCC has begun work with Chainlink to explore additional opportunities for blockchain technology within capital markets.

Tokenization and onchain finance can streamline various processes across the financial industry.

Tokenization and onchain finance can streamline various processes across the financial industry.

Streamlining operational processes via blockchains can drive beneficial organizational outcomes.

Together with the largest players in the financial industry, DTCC sees an opportunity to enhance the way financial data flows across the industry and how assets are settled across capital markets, bringing the benefits of blockchain technology to life.

As infrastructure leaders at the intersection of capital markets and blockchain technology, the collaboration between DTCC and Chainlink opens the door to a multitude of use cases that could redefine how the financial industry operates.

Blockchain technology is beginning to yield results related to efficiency, liquidity, and transparency in financial markets, but interoperability continues to be an area of opportunity and need. We look forward to working with Chainlink to uncover new opportunities to propel the digital asset ecosystem for the benefit of market participants and the broader industry.

This article first appeared on Chainlink on September 15, 2023.